It’s fair to say there was some trepidation in markets at the start of October, given its association with the infamous 1987 stock market crash and a steady rise in media commentary suggesting the US market had become overheated.

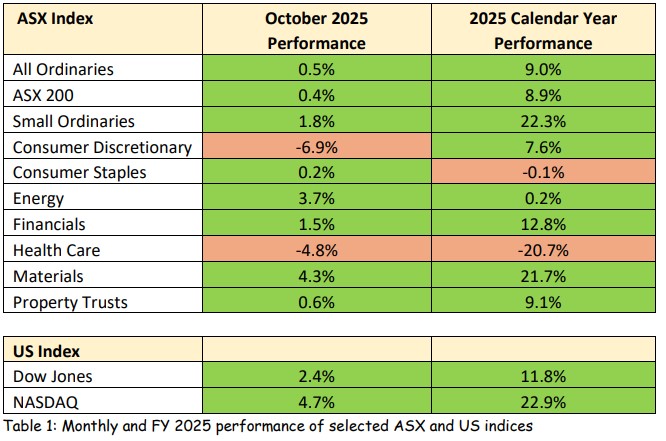

While these concerns persisted through the month, they appeared only to spur US equities higher, with the Dow gaining 2.4% and the NASDAQ a strong 4.7%. Much of this optimism reflected anticipation of a second US rate cut for the year – which the Federal Reserve duly delivered on 29 October, reducing its benchmark rate by 0.25% to a target range of 3.75%–4.00%.

In contrast, with no local rate cuts to act as a catalyst, Australian markets were more subdued, with the All Ordinaries and ASX 200 posting only modest gains of 0.5% and 0.4% respectively.

Materials and Energy were the prime movers gaining 4.3% and 3.7% respectively as all key industrial and energy commodities showed a steady or improvement in price.

This helped offset weakness in Consumer Discretionary, hurt by a near 10% fall in Wesfarmers after subdued AGM commentary, and in Health Care, where CSL remained soft following a downgrade to FY26 guidance.

Interest Rate Outlook

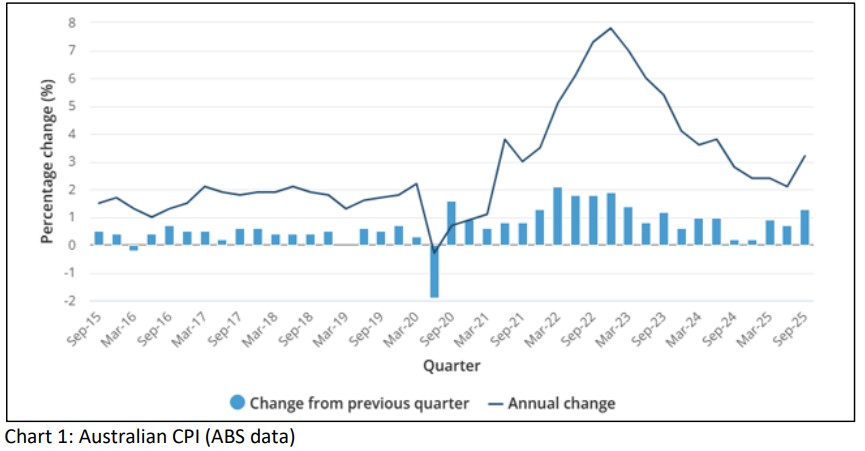

While US markets benefited from a reduction in official interest rates, a similar near-term move in Australia now appears unlikely following an increase in the annual Consumer Price Index (CPI) to 3.2% in the September quarter.

This reading sits above the RBA’s 2.0–3.0% target band and reflects a quarterly CPI rise of 1.3%, driven largely by higher energy costs as State and Federal Government subsidies were wound back.

Although this uptick in inflation was not entirely unexpected, it is likely to reinforce the RBA’s already cautious stance, and some commentators are now suggesting that the next move in Australian rates could even be an increase. We are not yet in that camp, but we would not be surprised to see the current official cash rate of 3.60% remain unchanged at least until the February 2026 meeting of the Reserve Bank.

The Resources Market

We mentioned earlier the strength in the Materials index and during October we saw lithium continue its price recovery and some key industrial metals – copper, zinc and aluminium for example, also show healthy gains – albeit some of the copper gains were the result of stockpiling caused by impending US tariffs.

The bull market in gold.

The gold price has gained 51% calendar year to date and during October we saw the gold price perform a “bull Market blowout” gaining 12.5% in the initial 20 days of trading and reaching an all-time high of $US4,372/oz, before quickly retracing to $US3,931/oz and closing the month at $US3,994/oz.

Whether this was the top of this bull run in gold remains to be seen – certainly rapid run-ups and equally fast corrections do often signal tops but until there is a broader market correction, we may well see more upside risk to the gold price than downside.

The Rare Earths Frenzy

During October, the market also experienced a short-term frenzy in rare earth stocks on the back of the US agreeing to assist with the development of rare earth projects within Australia.

Unfortunately, just as quickly as the share prices of our rare earth stocks rose they fell back again as investors with clear heads realised that rare earths require expensive processing facilities that have long development times.

No better example of this is Iluka Resources, which is a globally leading mineral sands producer that is constructing a rare earth processing facility at Eneabba. This facility will produce four key rare earth elements – neodymium, praseodymium, dysprosium and terbium and commenced development in early 2023. However, it will not be in production until early to mid-2027 and to date has already suffered capital cost blowouts of around $600 million.

During the October rare earths frenzy Iluka shares jumped 48% to a high of $9.48 but are now back near where they started at around $6.50 as investors refocus on the Company’s current operations which are suffering a period of low prices for rutile and zircon stemming from flat demand.

CSL

CSL was one of the industrial laggards we highlighted in last month’s report, noting that FY26 would be a transition year as the company restructures its operations to become leaner and more agile, and progresses plans to separate its CSL Seqirus division.

The share price weakness the Company had already been experiencing – and it’s fair to say 2025 has been a shocker – with the stock down around 40% was, in our view, an opportunity for longer-term investors to accumulate.

However, at CSL’s AGM on 28 October, the Company shocked the market by again revising its FY26 guidance lower than the already revised outlook provided less than two months earlier.

Downgrades of this magnitude can often be “stock killers”, as they raise concerns that management is not fully across its operations, or that unforeseen business or operational issues have emerged. In CSL’s case, management emphasised that the bulk of the business is performing to plan, with the key CSL Behring division continuing to drive growth.

The problem lies primarily with CSL Seqirus, which has experienced a sharper-than-expected decline in influenza vaccination rates in the United States. This has occurred despite supportive

recommendations from the US administration on influenza vaccines and an unusually high level of infection in the community.

In addition, CSL has seen reduced demand for albumin (a plasma-derived therapy used in treating burn victims, respiratory diseases, and conditions such as HIV and hepatitis) in China, reflecting government cost-containment measures.

Considering these pressures, the Company has put the demerger of CSL Seqirus on hold and revised its FY26 revenue and net profit growth expectations down by around 40%. The market reaction was swift, with the share price falling a further 15% to test lows near $168 before recovering slightly to around $176.

The stock is now trading around levels last seen in 2019. While FY26 will clearly be a year of transition, we believe the Company’s fundamentals remain sound and that, as the restructuring is completed, the share price should ultimately recover. Patience, however, will be required.

A Merry Christmas?

It is interesting to note that at their recent AGM’s several of our retail companies – including JB Hi Fi, Myer, Woolworths and Coles provided positive commentary for the Christmas trading outlook on the back of improving investor confidence.

Should this come to pass, it creates some potentially interesting buying opportunities across several of our retail sentiment sensitive stocks that have been sold down over 2025. The following is a selection of such companies and how we see their outlook.

Woolworths Group Ltd (WOW)

Woolworths is emerging as a compelling opportunity within the supermarket sector, supported by easing cost-of-living pressures and the ongoing resilience of non-discretionary spending.

Supermarkets are typically among the first beneficiaries as households begin to feel some relief, with shoppers favouring the convenience of a single destination and increasing basket sizes.

After two years of earnings downgrades, Woolworths appears to have reached an inflection point, with recent trading updates indicating stabilising momentum and no further cuts to guidance. The business retains a strong competitive position as Australia’s leading supermarket, underpinned by the largest supermarket store network, efficient supply chain and highly defensive earnings profile.

Looking ahead, earnings per share are forecast to grow by around 11% p.a. over the next three years, driven by margin recovery and more stable consumer demand. Woolworths presently trades on approximately 22.1x forward earnings with a 3.4% dividend yield, versus Coles on 25.8x forward earnings with a similar yield. If current conditions do mark the trough in revisions, the combination of earnings growth, multiple re-rating potential and dividend support offers attractive upside for longterm investors.

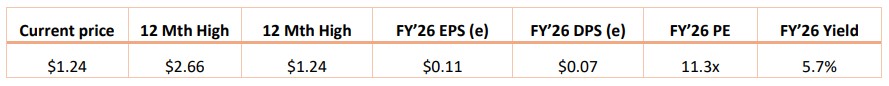

Accent Group Limited (AX1)

Accent Group, founded in New Zealand in 1988, has grown into one of Australia’s leading retailers and wholesalers of sporting and leisure footwear, reaching 825 stores in FY2025. In April 2025, the Company secured the rights to operate the UK Sports Direct business across Australasia for an initial 25-year term, with Sports Direct’s owner, Frasers Group PLC, acquiring a 19.6% stake in Accent at $1.78 per share. This strategic partnership underscores the appeal of Accent’s platform and growth potential.

Rapid expansion has, however, brought growing pains. Throughout 2025 the Company has focused on consolidating its footprint, closing underperforming stores and product lines while broadening its offer into sports apparel to complement footwear sales. This period of restructuring has weighed on market sentiment, pushing the share price towards three-year lows and leaving the stock trading on valuation multiples that appear undemanding relative to its earnings profile and market position.

While sales growth for the September quarter is expected to be flat, Accent is well placed to benefit from any improvement in consumer sentiment, particularly into the key Christmas trading period.

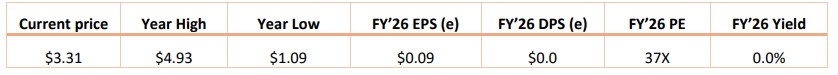

Zip Co Ltd (ZIP)

Zip is a 2013-founded Australian Buy Now, Pay Later (BNPL) provider with operations in Australia, New Zealand and the United States. After a period of restructuring to focus on these core markets, the business has reached an important inflection point: it is now cash-flow positive, generating profits and still has substantial growth runway, particularly in the US.

A potential NASDAQ listing in the first half of 2026 adds a further layer of upside optionality. Should this proceed, increased visibility and access to a deeper pool of US growth and fintech investors could provide a meaningful catalyst for the share price.

Operationally, momentum is strong. In the September quarter of FY26, Zip reported total transaction volume of $3.9 billion, up 38.7% on the prior corresponding period, EBITDA of $62.8 million (+98.1%), and 6.4 million active customers (+5.3%). This sets a solid platform heading into the December quarter, which is typically seasonally strong as Christmas-related spending lifts demand for credit.

From an investment perspective, Zip remains a long-term, higher-risk growth exposure. Earnings per share are forecast to grow at around 15% p.a. over the next five years. Given the likely share price volatility, a staggered approach to building a position is recommended for more growth-oriented investors.

Looking Ahead

Trump-induced volatility notwithstanding, we remain slightly cautious given the elevated valuations across broader equity markets. That said, overall investor momentum is still positive and the nascent recovery in commodity prices is signalling a healthier backdrop for global growth in 2026.

We hope you continue to find these monthly reports useful and informative. If you have any feedback on the content or format – for example, the balance between economic commentary and stock ideas – please share it with our office. Your input is always welcome and helps us refine the reports to better meet your needs.