THE HORIZON PERTH OFFICE HAS MOVED INTO A NEW OFFICE. PLEASE NOTE OUR NEW

ADDRESS; LEVEL 22, 240 ST GEORGES TERRACE, PERTH WA 6000

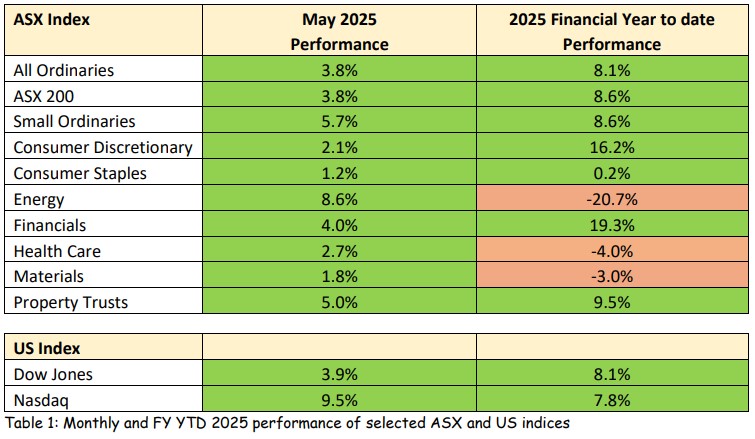

May saw all major Australian indices finish in the green, with a recovery in Energy leading the way, followed by Small All Ordinaries and Property Trusts (REIT’s). Both US indices performed similarly, with the Dow gaining an impressive 3.9% and the Nasdaq 9.5%; as favour returned to the tech sector.

The strong performances across the board in May reflected a continuation of the return to positive sentiment that commenced in early April as the market digested more carefully the implications of the Trump tariffs, their potential size and timing of implementation.

In fact, the markets are presently all about Trump’s tariffs, his utterances are rarely off the front

page and have been shown to have the ability the move markets very significantly, both up and

down.

It appears that US tariffs are here to stay but will be watered-down from what was initially

proposed and subject to regular change, as the US President uses them as a major negotiating tool across a range of issues. Being President of the world’s largest consumer market brings with it a certain power….

As we move further into 2025, the world’s financial markets do appear to again be at an inflection point. Many of the dominant economic forces at play are not new, but the scale and urgency surrounding them are escalating. I wanted to share some insights drawn from a recent interview with renowned macro investor Vimal Gor (Interview) and offer a few thoughts on how they align with our current strategy.

Let’s start with the United States, the beating heart of the global financial system. The headlines may focus on tariffs, inflation readings or Federal Reserve rate decisions, but beneath the surface lies a far more structural issue: the U.S. fiscal position is deteriorating at a rapid pace.

The U.S. Fiscal Problem: Too Much Debt, Too Little Will

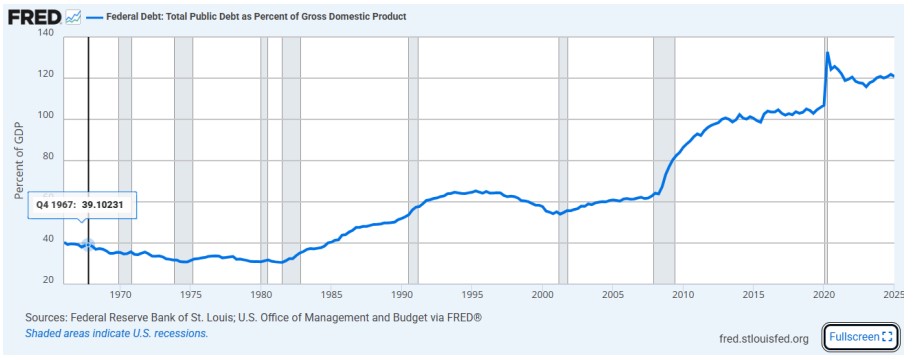

America’s debt burden has reached historic highs, now well over 120% of GDP and climbing. This is not just the legacy of pandemic spending. It’s the result of a structural mismatch between tax receipts and public spending. Worse still, this is happening in a world where the cost of borrowing is no longer negligible.

- *Source: Federal Reserve Bank of St. Louis, FRED*

This elevated debt-to-GDP ratio underscores the fiscal challenges facing the U.S. government, particularly in managing interest payments and refinancing obligations. The U.S. government is now facing the painful task of rolling over trillions of dollars of Treasury debt at significantly higher interest rates than when that debt was first issued. To address this, the US government may have to resort to Quantitative Easing.

What is Quantitative Easing (QE), and Why Does It Matter?

QE is a tool central banks use when they want to lower interest rates and inject liquidity into the financial system. The Federal Reserve does this by buying government bonds in large volumes, which pushes bond prices up and yields (interest rates) down. The side effect of this is that the U.S. government, who issues those bonds, gets to refinance its debt at more manageable rates.

Put another way, QE is fast becoming not just a response to a slowing economy or market stress, but a fiscal necessity. With a record volume of U.S. debt maturing in the next 12–24 months, in the second half of 2025, the Fed may be forced to step in and buy bonds because the alternative is financially unsustainable for the government.

A Weaker U.S. Dollar Is Likely

One of the most likely consequences of printing more money is that the value of existing money goes down. In this case, it’s the U.S. dollar that will likely suffer. We consider three significant forces in play that point towards a weaker U.S. dollar from here:

- Policy intent: U.S. officials have been openly supportive of a weaker dollar. It is supportive for American business, it makes American exports more competitive and helps inflate away debt in real terms.

- Rate differentials: If U.S. interest rates fall, as expected, investors seeking yield may begin looking elsewhere, especially in countries where central banks are still holding rates higher.

- QE itself: As mentioned, increasing the supply of money devalues the currency. This is true whether you’re printing physical notes or electronically expanding the Fed’s balance sheet.

Hard Assets Should Continue to Shine

In times when paper money is being devalued, hard assets — those that are tangible and finite — tend to do well. Commodities remain particularly well-positioned. We’re already seeing signs of renewed strength across these markets, and this trend could accelerate as liquidity returns to the system and the U.S. dollar comes under pressure.

It’s worth noting that many central banks around the world are adding to their gold reserves. This is another vote of no confidence in the longer-term stability of the U.S. dollar.

While equities are not hard assets in the traditional sense, they can also benefit from increased liquidity, especially if interest rates fall. But this comes with an important caveat.

Don’t Forget the Elephant in the Room

As Vimal Gor rightly pointed out, the rally in risk assets in anticipation of QE, shares, gold, commodities, is being underwritten by the anticipated Federal Reserve response to a deepening debt crisis. This is not the kind of rally that springs from genuine productivity improvements or corporate innovation. It is liquidity-fuelled, and therefore fragile.

Eventually, the bill for U.S. fiscal excess will come due. The difficult question is not if, but when. Will it be 5 months from now, five years or fifty? No one knows for certain, but as stewards of your capital, it’s our responsibility to manage portfolios with this uncertainty in mind.

Our Strategy: Cautious Optimism, Measured Risk

Given this backdrop, we are maintaining a cautiously invested position. We continue to hold a meaningful allocation to defensive assets including cash and hybrid securities. These provide stability and optionality if volatility re-emerges.

We are underweight international investments and were possible are hedged to protect against a falling US dollar.

For the growth portion of portfolios, our focus is on quality companies trading on undemanding valuation multiples, those we believe are in a good position to weather uncertainty while still offering upside. We are not chasing hype or momentum but rather we are looking for real businesses with strong cash flows that are trading on undemanding earnings multiples.

Some of our current preferred holdings include:

- Amcor – a global packaging leader with stable cash flows, pricing power, and exposure to defensive end markets.

- CSL – a global leader in plasma-derived therapies and vaccines, trading at more reasonable multiples after recent underperformance.

- Treasury Wine Estates – well-placed to benefit from the reopening of the Chinese market, with strong brand recognition and export growth.

- South32 (S32) – a diversified miner with exposure to battery metals and bulk commodities, offering leverage to a weaker USD and a stronger commodity cycle.

- Worley – a high-quality engineering business that stands to benefit from long-term decarbonisation trends and global infrastructure stimulus

Final Thoughts

We are living in a world where monetary and fiscal policy are deeply intertwined, and where traditional signals often get drowned out by political necessity. That doesn’t mean markets will collapse tomorrow. In fact, as liquidity increases, asset prices may continue to rise. But the underlying risks are real—and in some ways, building.

Our job is to stay informed, stay balanced, and avoid complacency.

As always, thank you for your continued trust. If you have any questions or would like to discuss your portfolio, please don’t hesitate to get in touch.