Please find attached your monthly report for the month of August. The transition to the DASH

reporting platform is ongoing and, while substantial headway is being made, substantial work is still required. This includes improving the presentation of portfolios as attached. Dash is committed to enhancing the quality of reports and this will be a priority once all data feeds are again operating smoothly.

Similarly, the on-line client portal leaves a lot to be desired and this is acknowledged. To provide a timely solution, DASH is arranging for client portfolio viewing via the Advisor web interface and this is expected to be live from Wednesday 17th September. Come next Wednesday, to view your portfolio online via the Advisor portal please follow the instructions as provided in this Link.

The website address is https://app.mdaoperator.com.au and on entering your email and resetting your password you will gain access to the advisor portal.

We thank you again for your patience over the transition and like you, we look forward to a rapidly improving user experience in the months ahead.

It’s fair to say that with August being the corporate profit reporting month and more importantly the month where earnings outlook is provided for the 2026 financial year, the Australian markets in August could have shown a negative return.

History will show however that, despite some very mixed results and outlooks that could at best be described as cautious, our markets enjoyed one of the better Augusts on record. This optimism was certainly boosted by the 0.25% cut in cash rate to 3.60% by the RBA on 12th August and continued strength in the United States share market.

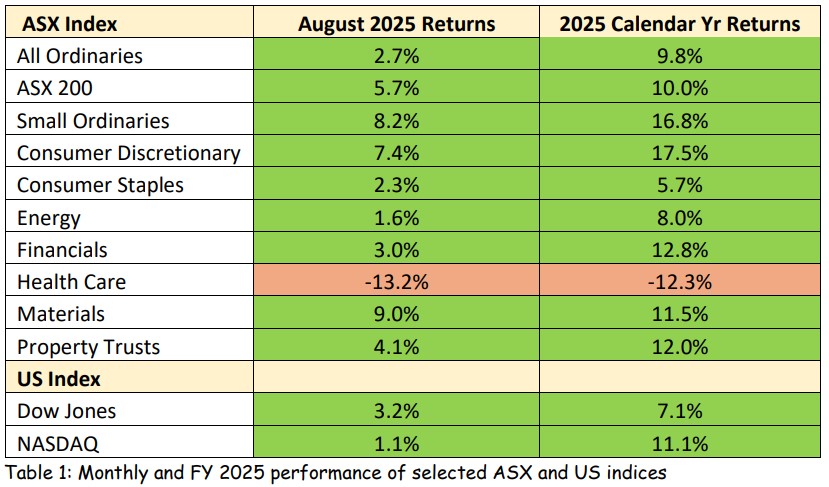

In our market, the standout sub-indices were Materials (+9.0%) as we saw increased counter cyclical interest in our miners, Consumer Discretionary (+7.4%) with strong share price gains seen across stocks such as Harvey Norman, JB Hi-Fi and Tabcorp and the Small All Ordinaries (+8.2%) as investors went searching for cheaper priced shares outside the ASX 50.

Property Trusts (+4.1%) also benefited from the rate cut with investors seeking the higher yields

available across this sector and whilst Energy had a quieter month (+1.6%) after last month’s 5.7% rise, the sector still showed positive territory as the market reacted favourably to the full year results from Origin Energy and Worley.

Health Care was the laggard, losing 13.2% after a strong July which saw it gain 9.1%. This volatility was caused largely by CSL, with the company’s share price losing 22% after achieving guidance with its FY’25 result but underwhelming analysts with its outlook into FY’26.

At the same time, the company’s decision to demerge as a new ASX listed entity its seasonal influenza vaccine and adjuvant (immune response) technologies division – CSL Seqirus – together with a 15% reduction in work force across the entire company, has created uncertainty which, in market parlance, equates to share price negativity.

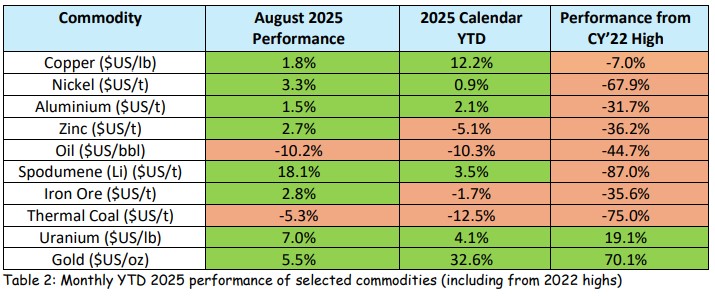

In commodities, during August all key industrial minerals showed price rises with lithium concentrate showing a price spike (+18.1%) due to the shutdown of a significant volume of Chinese production. This price rise brought our lithium stocks to life with the share price of Pilbara Minerals and Mineral Resources being significant beneficiaries.

The uranium price also showed a healthy gain of 7.0% and the outlook for this commodity is gaining momentum through expanding nuclear capacity, a tightening of existing enriched supply and the long lead time needed to expand mine production to meet the growing demand.

The gold price continued to enjoy its unprecedented bull run fuelled by physical buying by central banks and gold ETF’s.

Australian Interest Rates

Australia’s inflation rate increased unexpectedly to 2.8% in July, which is near the top of the RBA’s target range of 2-3%. Whilst not completely killing the chances for a further cut of 0.25% at the RBA’s 29-30th September meeting, it does diminish it and our view is the RBA may prefer to sit tight and wait to ensure the August and September inflation rate does not show a further rise.

As a result, we may not see the next rate cut announced until the 3-4 th November meeting.

The Reporting Season

The August reporting season confirmed that corporate Australia is doing it reasonably tough with many companies reporting low to mid-single digit expectations for earnings growth for the upcoming financial year.

Such an outlook would normally see a subdued response from the equities market – equities after all thrive on earnings growth – but instead we saw an accentuated but mixed response from the market with some shares significantly rewarded for average results and others punished for much the same.

This had much to do with the guidance provided and it became quite apparent from reporting that FY 2026 could be a consolidation year for many companies, with real earning’s growth not expected until FY 2027.

CSL was a case in point. While we do expect its share price to recover as the demerger of CSL Seqirus becomes better understood and the benefits of the leaner CSL become apparent, share price appreciation may not commence with any conviction for another 6-9 months.

A similar example is James Hardie, which reported in line results for its first quarter FY’26 (James Hardie has a March financial year) but a very subdued outlook for the next 6-9 months – due to a sluggish building cycle within its’ major market the United States – saw its share price plummet. The Company is also still absorbing its recent acquisition of AZEK, a US manufacturer of outdoor decking railing and accessories such as pergolas, which also significantly increased its corporate debt.

Against these stories were stocks such as Amcor which, despite achieving guidance and painting what we consider a solid outlook for FY’26, suffered a share price loss as investors apparently wanted more.

In this regard, we think the market is missing the bigger picture, being synergies it is extracting from its recent merger with Berry Global as well as, longer term, Amcor’s leverage to global economic growth through its position as a leading global manufacturer and supplier of packaging.

This merger, which was completed in April and valued at around $US13 billion, saw the Berry Global group, which was a competitor of Amcor, combine to give the company global scale with around 400 manufacturing plants across 200 locations and access to all major markets including China.

With a very undemanding PE ratio of less than 11 times, an unfranked dividend yield of around 5.5% (paid quarterly), growth forecast in the year ahead and trading near 5 year lows, Amcor is one of our preferred portfolio stocks.

The Market Outlook

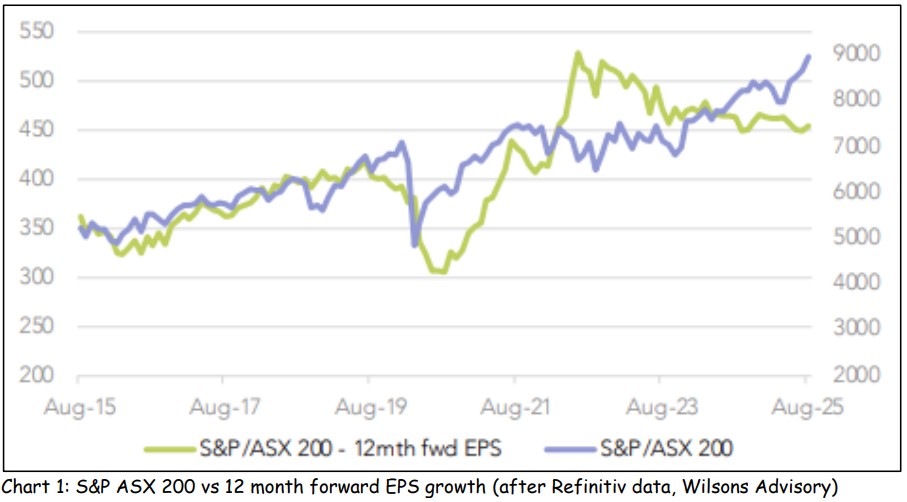

In our July newsletter we suggested caution as it seemed the market was becoming locked into a goldilocks syndrome where all the news is good even when it is not and the fear of missing out creates a clamour for stocks even when their earnings outlook is subdued.

As the market often does, it proved us incorrect, and in August the major Australian indices continued to create new highs.

In this regard there are plenty of “top down” arguments why the share market should continue to rise; falling interest rates for one, a return to global growth as the US (apparently) powers ahead and major EU economies such as Germany reindustrialise through defence spending.

But equally, from a ”bottom-up” perspective (and as the reporting season has shown), company earnings are not keeping up with this euphoria and we continue to see PE expansion rather than significant earnings growth.

As the following chart shows, earnings growth has been dropping for the past three years yet the Australian share market has kept rising.

Despite our caution, we do see value in certain stocks such as Amcor, which appears mispriced. Stock selection remains the key but, for at least the next few months, we also suggest maintaining a reasonable cash weighting as we enter one of the more traditionally volatile times of the year for our share market at a time when valuations are elevated.

Please do not hesitate to contact our office if you would like to discuss any aspect of your portfolio in more detail.