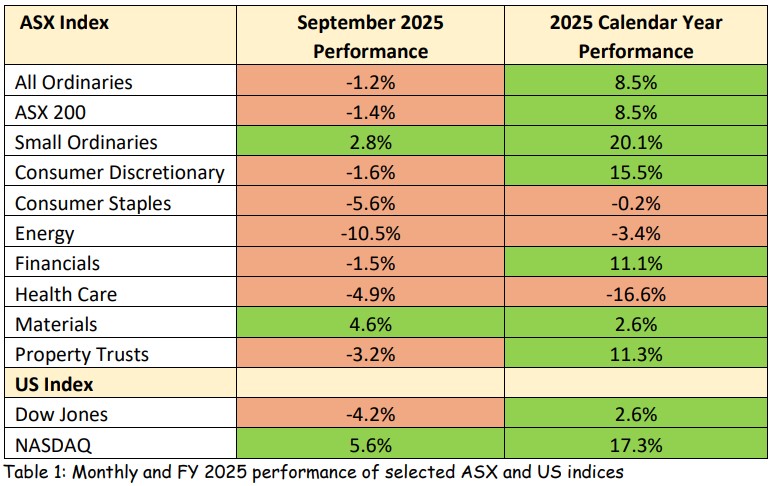

September is usually the weakest month for the share market. While predicting short-term share market movements is fraught, in this case markets again followed script. The Dow Jones gave back 4.2%, and most Australian indices also lost ground.

In the US, much of the selling on the Dow Jones and NASDAQ Indices had to do with annual book squaring. In Australia, the price weakness was more to do with our major stocks trading ex-dividend and their share prices consequently falling by the dividend amount. As such, the negative index movements experienced had little to do with investor sentiment.

A key September takeaway for the Australian market was the continued positive performance from the Materials index. The switching into resources that commenced in late June gained further momentum during the month and consequently drove the Materials index to a 16 month high of 18,815 points – up nearly 21% from recent lows recorded in late June.

Much of this gain can be credited to the gold stocks in the index as they continue to create new highs on the back of the surging gold price. However, stocks like RIO and BHP have also helped as iron ore prices held above $US100/tonne. This was despite expectations that Chinese demand would soften in the September quarter. The December quarter is historically a positive one for the iron ore price, so it will be interesting to see if this positive momentum continues.

The main laggard during September was Energy, largely due to the Santos share price falling 15% after the XRG Consortium withdrew its takeover offer of $US5.63 ($A8.53) per share. This negativity extended to Woodside, which also lost ground by a similar amount.

Consumer Staples were also weaker thanks to the Woolworths share price loosing nearly 21% as investors continued to dump the stock after a lacklustre FY’25 and a flat earnings outlook for FY’26, especially when compared to Coles.

Weakness continued in the Health Care sector as investors reacted negatively – perhaps unfairly – to Sonic Healthcare’s result and the digesting of CSL‘s decision to demerge CSL Seqirus.

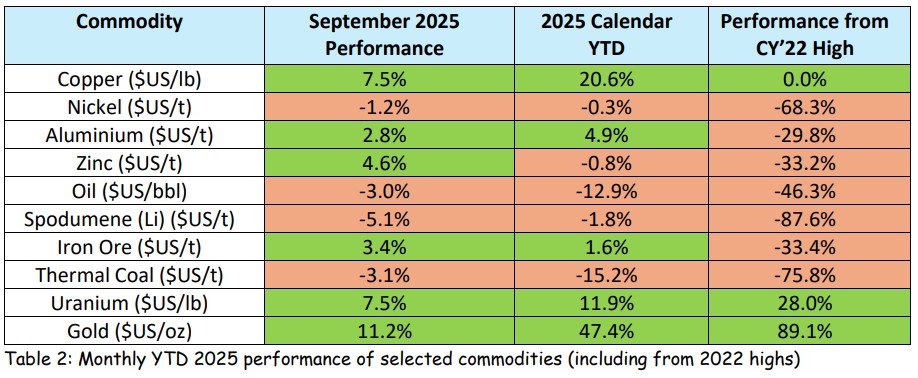

On the commodity front, as mentioned earlier, the yellow metal continued to lead the way with uranium and copper also showing good gains.

Our current gold bull-market appears to be primarily driven by global investors dumping the US dollar on the expectation of further US dollar weakness and those seeking an alternative “safe haven”. To add fuel to the fire, investors have been charging into gold exchange traded funds (ETFs), which are then required to buy the physical asset to match investors funds.

This booming gold price is creating enormous wealth for our gold miners, many of which would ordinarily have marginal operations relying on high tonnage processing because their head grades are little better than 1gram/tonne. Instead, it is indeed Christmas for these miners, with the value of a gram of gold now worth over double the $US60 it was valued at a little over 18 months ago.

Where and when this bull market for gold will end is anybody’s guess. Gold, unlike other commodities, has limited industrial use, so a standard supply versus demand analysis does not inform. Consequently, predictions are simply speculation. With that said, momentum for gold is very much on the up.

A final observation about gold is that the United Sates retains the largest gold reserves of any country with 8,133 tonnes held. Presently worth just over $US1 trillion, this seems minor when compared to current US debt of around $US33 trillion. Coming second is Germany, with around 3,500 tonnes followed by Italy at 2,600 tonnes, France at 2,500 tonnes, and Russia and China both with around 2,400 tonnes.

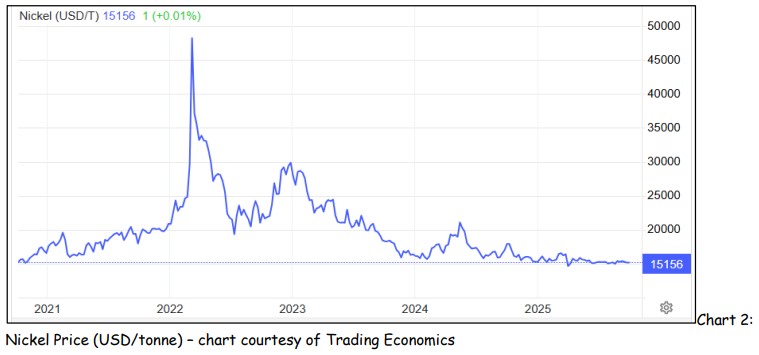

In looking for the next commodity that may launch, we consider nickel a possible candidate. While there is a current supply surplus, ongoing news is of supply being curtailed. Examples include BHP permanently shutting its WA nickel operations and Indonesia placing greater curbs on nickel production due to environmental concerns. Conversely on the demand side, the usage for nickel continues to widen, including as a key component in next generation battery storage for cars and houses. With supply curtailed and demand likely to grow, the current excess supply could reverse to become a supply deficit, auguring well for nickel’s longer term price outlook.

Industrial Laggards

As we commented last month, the recent reporting period for our ASX industrial companies was best characterised as underwhelming. Many companies face operational challenges which, to resolve and restore earnings per share growth, will require significant restructuring. Investors have been unimpressed and consequently, a number of these former market darlings have suffered significant share price falls over the past few months. We detail a selection of such companies and how we see their outlook.

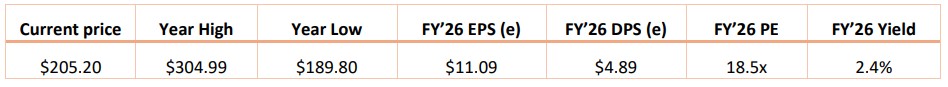

Woolworths (WOW)

Woolworth is paying a high price for a focus on wokeness practised under the previous CEO. By taking its eye off the ball in what is a very competitive market, it has lost market share to rivals such as Coles, Aldi and Metcash. Its initial 8 weeks of revenue for FY’26 show that customers are still going elsewhere.

On the positive side, the Company has spent significant capital on improving its distribution centres and, once shoppers return, margins should expand. It is now up to management to prove they can restore the Company to its former glory as Australia’s premier supermarket player.

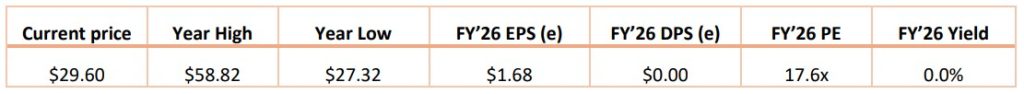

CSL Limited (CSL)

Although CSL met guidance for FY’25, it spooked investors with a decision to cut its global workforce by up to 15% through FY’26 and FY’27 and by announcing its intention to demerge its CSL Seqirus division.

In addition, the 100% tariff placed on pharmaceutical imports into the US created further uncertainty, even though CSL has indicated that the tariffs will have little effect on earnings given its substantial US based operations.

The Company is trading at price levels last seen in 2019 and while 2026 will be a year of transition, its fundamentals remain sound, albeit with more subdued earnings growth when compared to what was previously forecast.

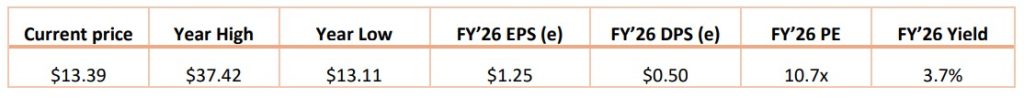

James Hardie (JHX)

James Hardie scored a recent trifecta by blindsiding the market with its overpriced merger with AZEK, failing to disclose some pertinent intercompany professional relationships related to the transaction and shocking the market with its 1Q26 result which was well down on guidance and which indicated a rapid softening of its key North American market.

The resultant loss in market confidence for the Company will take some time to work through and will be compounded if the US housing market continues to be soft, though there is some recent evidence to suggest the US housing market may be starting to improve.

The above aside, James Hardie is a market leader with significant leverage to the US economy. While any recovery in the share price is unlikely to be immediate, we expect it will come as the Company’s fortunes improve from what is, in part, some significant self-inflicted wounds.

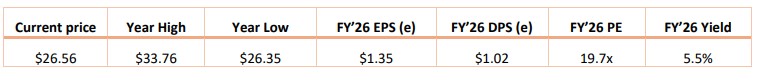

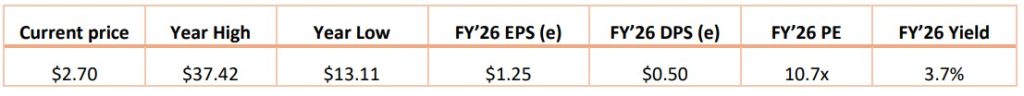

Domino’s Pizza (DMP)

Dominos achieved record earnings during Covid and a share price that reached $167.15. But it has been all downhill since then as falling customer numbers throughout its European and Japanese operations have forced significant store closures. Adding to the pain, two CEO’s have left the company within 12 months, causing managerial disruption, and the Company has been forced to re-invigorate its food offering to regain relevance in the takeaway market.

However, much of the restructure (read store closures) necessitated by these events is now complete, the Company’s well thought of Chairman is now steering the ship in an executive capacity, and discounting to grow market share is a thing of the past.

While sales growth for the first few months of FY’26 has been lack-lustre, the structural changes have been significant, and we expect will provide long term benefits.

South 32 (S32)

South32 delivered a healthy result for FY’25 but the share price has taken a recent hit with recent news that, due to failing to secure commercial electricity supply beyond March’26, the Company will place its Mozal aluminium smelter in Mozambique onto care & maintenance from that date. As a result, it would be taking a $US372 million impairment to its FY’25 accounts.

The shutting of commercial operations due to cost escalation is never positive news. We hope that the Mozambique government recognises the economic consequences of such a shut down and can intervene at the 11th hour to help keep the smelter open and viable.

In the meantime, S32’s other operations are performing well. The significant US based Taylor zinclead-silver mine development is on schedule, and when in production will be a significant boost to earnings.

Looking Ahead

In December 1996 Alan Greenspan, the then Chairman of the American Federal Reserve Board made his famous statement that the markets, notably the US NASDAQ index, were showing ”irrational exuberance” in relation to the then boom in technology stocks.

His statement had a short term effect on global markets but all quickly recovered and the boom in the NASDAQ continued for another 39 months before finally topping out in March 2000 and then losing nearly 74% of its value before bottoming in August 2002.

Interestingly (or perhaps just co-incidentally), the NASDAQ bottomed at nearly the same level as it was when Greenspan made his famous statement.

The point to make is that whilst Greenspan was eventually proven correct, in the intervening period investors who followed his cautionary advice would have missed out on an additional 286% upside in the NASDAQ and 74% in the Dow Jones before they both topped out.

But the investors who ignored him had another 3 years in which to enjoy substantial gains and if they stayed fully invested (although it is wise to take some profits) they would have ended up actually losing very little, if any of their capital because of where the market bottomed.

The reason we make this comment is because you have no doubt noted an increasing number of media articles speculating that a significant correction in equity markets is overdue. Likewise, you would also be aware that in our past few monthly newsletters we have expressed caution as it felt the market was getting ahead of fundamentals.

While we believe there are sectors of the market that are overvalued (our banking and technology sectors in particular), we consider that there are other areas of our market that offer significant value with scope for material underlying share price appreciation.

The December quarter is traditionally a strong quarter for equities, thanks to investors being cashed up from dividends paid in August and September as well as share prices being supported by companies undertaking share buy backs.

For that reason, while we were cautious for a share pull-back before Christmas, if such a pull-back eventuates, it may not be as severe as we previously felt it could be. As a result, we are comfortable to increase equity exposure, particularly in shares we consider undervalued. As always, stock selection remains the key and a sensible strategy is to stagger this suggested increase in market exposure by buying selected shares on a gradual basis. As always, to continue to retain a decent cash buffer to deal with the unexpected and unforeseen.

If you have any feedback on the content or format, please don’t hesitate to share it with your adviser as we always welcome your critique.