Change Investment Reporting Vendor

As you may be aware, our back office - Integrated Portfolio Solutions (IPS - now owned by DASH) - ceased its arrangement with reporting vendor Praemium.

Consequently, effective the end of July, portfolios are now being reported via the DASH portfolio platform.

The change in underlying platform is a huge logistical undertaking, that has not been aided by a hard cessation date determined by Praemium. In addition to ensuring DASH reporting can

accommodate the bespoke nature of our portfolios, as well as a large data migration, this has

required the reconfiguration of many data feeds and staff training on the new system, as well as the maintaining of ongoing business services.

Unsurprisingly, there have been a few bumps in the road. I have been in ongoing contact with

IPS/DASH and have a high degree of confidence that the outstanding issues have been identified and will be resolved such that IPS is back to ‘business as usual’ status by the end of August.

This includes items such as not showing the cost base of investments held, bank accounts being reconciled and up to date and the correct coding of assets to appropriate asset classes.

One item that has come to our attention is that not everyone appears to have received new client portal logon details. To address this, simply go to www.horizoninvestmentsolutions.com.au, click the ‘Log In’ button on the top right of the screen, follow the prompt to enter your email and then click ‘forgot password’. You will then be able to create a password along with obtain the added security of 2 Factor Authentication.

Should IPS not have your current email address, please contact our office so we can update.

Please note that we consider the layout of the client portal to not be entirely satisfactory for our client portfolios. IPS/DASH have communicated that it is an absolute priority to improve the user experience and to expect substantial enhancements over the upcoming months.

Many clients will recall that the transition to a new reporting platform is something we have

experienced previously. In 2009, when Morgans transitioned to a new reporting platform, the

process took the best part of a year and was the reason we departed the organisation. IPS/DASH are disappointed with many aspects of this transition. However, from my past lived experience, should IPS/DASH bed this transition down within a month, I will personally consider this a satisfactory outcome.

However, this is to not take anything away from the frustration we know people have felt as they have struggled to view their portfolios on-line over the last few weeks. Again, I assure you this will be temporary and thank you for your understanding.

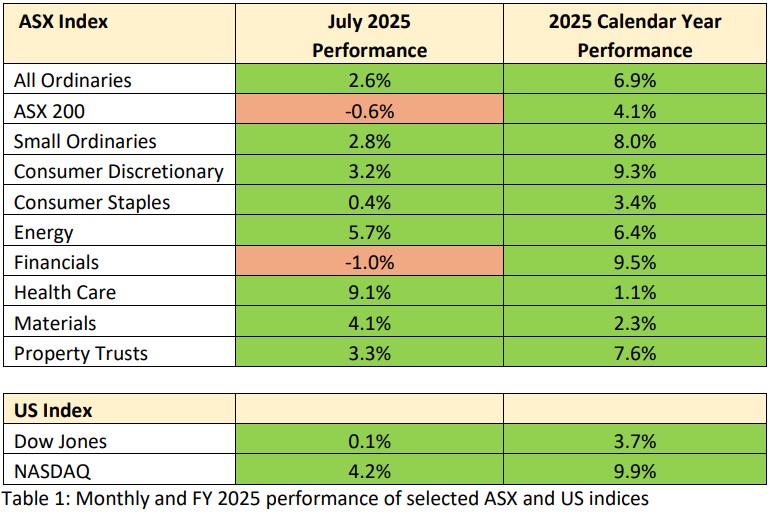

July 2025 opened positively as the Australian market adjusted to the new Trump world order and the raft of tariffs that were being negotiated across the United States major trading partners.

Whilst US tariffs could dampen global output – and be potentially inflationary – during July these concerns were largely pushed aside and our market instead focused on China and European economies showing signs of emerging from a growth slump.

This optimism was no better exemplified in the Australian market than by the performance of the Energy and Materials indices, especially relative to Financials. In past markets, when economic growth is seen as recovering – and hence demand for commodities growing – the move to a greater resource weighting in portfolios often sees weakness across Financials. We saw this potentially commence in July.

Across the Pacific, the Dow Jones was subdued as some economic news, such as weak jobless numbers, suggested the US economy was slowing. However, the tech heavy NASDAQ continued to power ahead as AI fervour gripped investors’ attention.

On a calendar year basis, all the major Australian indices are now in the green, with the interest rate sensitive sectors Financials and REITS (property trusts) leading the way. With a 0.25% cut in domestic rates occurring at the RBA August meeting, REITs should continue to attract investor interest. Given the banks exceptional gains over the past 18 months, and our earlier comment regarding the possible switch into resource shares, we remain cautious across Financials.

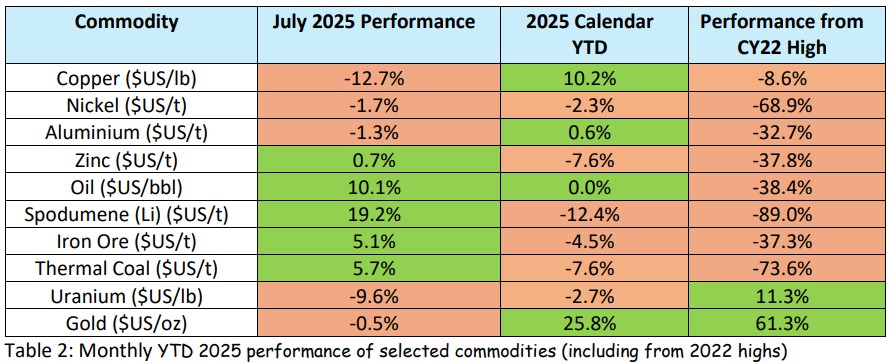

Across resources, July was a mixed month highlighted by a strong recovery in lithium prices, the result of the suspension of some Chinese production. In contrast, copper retreated sharply from recent highs, as it showed a savage retreat from recent highs as Donald Trump backed away from tariffs on copper entering the United States.

Apart from uranium, which suffered from some traders taking profits in an illiquid physical market, the other energy commodities – oil and coal – performed well and in tandem with iron ore as demand from China appeared to improve.

It will be interesting to see if the renewed interest in the resource sector persists over the coming months, especially given the many geopolitical tensions that can provide upward catalysts through restriction of supply.

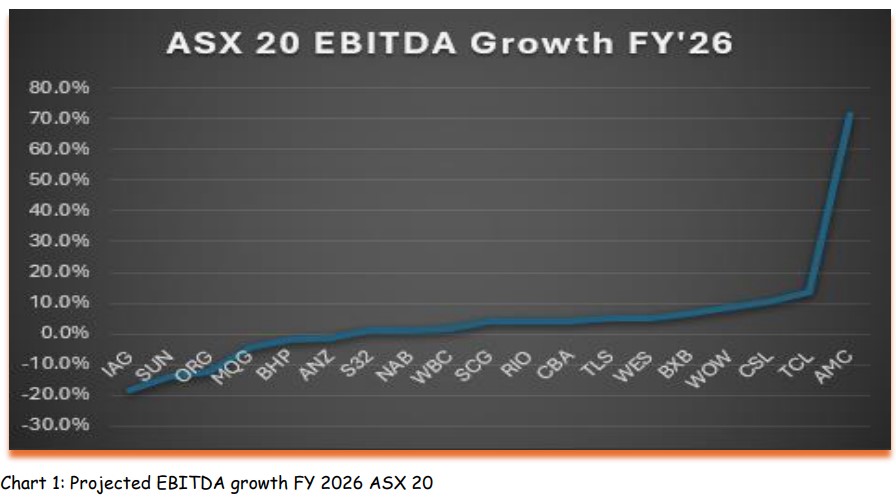

Looking at the broader market, August sees the reporting season for Australian companies. Attention then focuses on the outlook that companies provide for the upcoming year.

The following chart shows the projected growth in EBITDA (earnings before interest, tax and depreciation and amortisation) for FY 2026 for the stocks in our ASX 20 index.

EBITDA growth depends significantly on the economy. As we have highlighted in past monthly

letters, the most significant economic positives for Australia that readily come to mind are that

inflation is lower and, by extension, interest rates are heading down.

We would like to be more positive, but the upcoming Productivity Roundtable will be a case in point. Undoubtedly long on words, short on detail and lacking real world economic substance. The focus increasingly appears to be on how to divide the pie (tax policy), as opposed to how to make the pie larger and consequently allow for more to go around.

The vision that we require to ensure Australia’s economic future is non-existent, and our politicians, unions and big business can all share the blame.

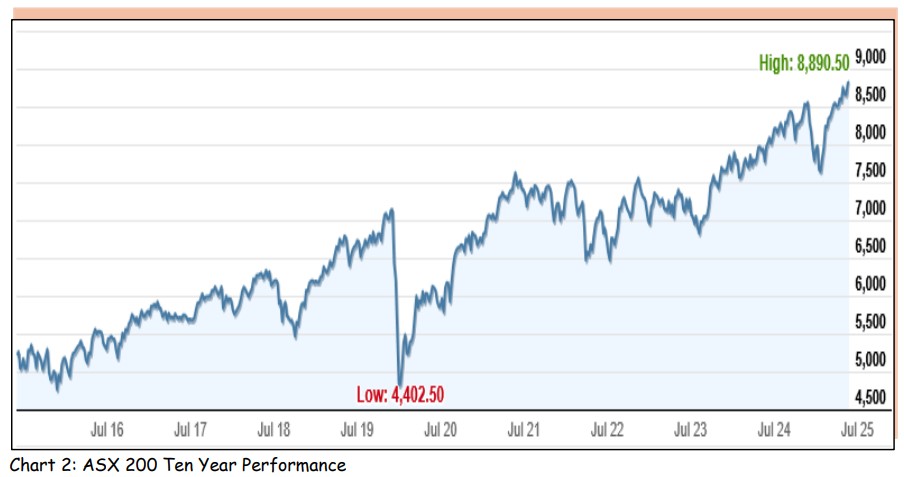

Despite this, and admittedly our comments are pessimistic, our major share market indices are at or near record highs (see below) and are apparently seeing a different Australia to the one we are describing.

The earnings season will be the ultimate judge and, if as we suspect, most companies report a relatively benign earnings outlook for FY 2026, then the share market may well retrace.

For this reason, we are cautious in the short term and would not be surprised to see some market weakness post the reporting season as the market readjusts its expectations to match our expectation of lower-than-expected earnings growth.

Please do not hesitate to reach out with respect to any matter concerning your investment portfolio. Again, on half of IPS/DASH, I apologise for the reduced online reporting transparency and look forward to this issue being addressed within the foreseeable future.