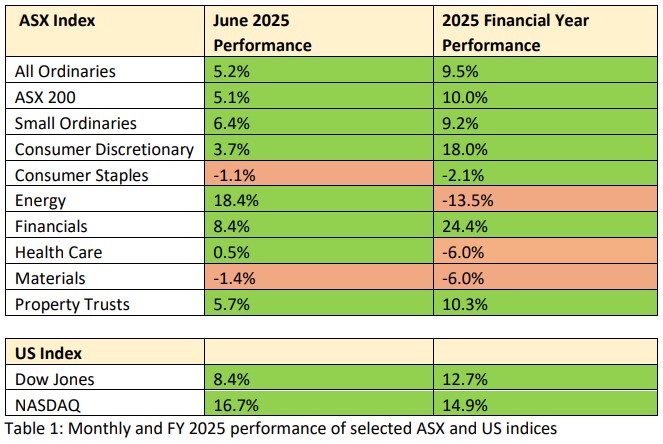

June 2025 delivered strong gains, with the All Ordinaries and ASX 200 both rising over 5%, a welcome surprise in what is typically a volatile month. Most sub-indices also posted gains, driven by strength in Energy and Financials.

Energy led the charge after oil prices surged 11.9%, sparked by escalating tensions between Israel and Iran. The sector returned 18.4% for the month, although it remained in the red over the full year.

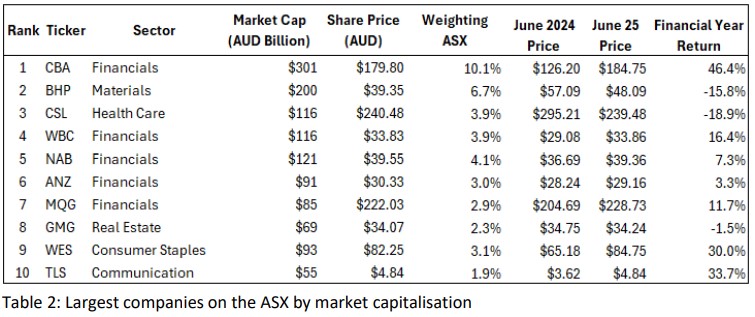

Financials followed closely, with standout results from CBA, which reached a record $192.00 before closing at $184.75—up 50.7% for the year. This performance came despite most analysts declaring the stock overvalued when it crossed $130.00 in July 2024. QBE also gained 39%, with Suncorp and Westpac rising 26% and 25%, respectively. Overall, the Financials index returned 24.4% for FY 2025.

Consumer Discretionary was another strong contributor, finishing the year up 18.0%. JB Hi-Fi surged 82%, while Aristocrat Leisure added 32%.

Materials, by contrast, continued to lag, down 1.4% in June and consistently the weakest sector throughout FY 2025.

Across the Pacific, US markets extended their recovery from the March tariff shock. The Dow gained 8.4% and the NASDAQ rose an impressive 16.7% for the month.

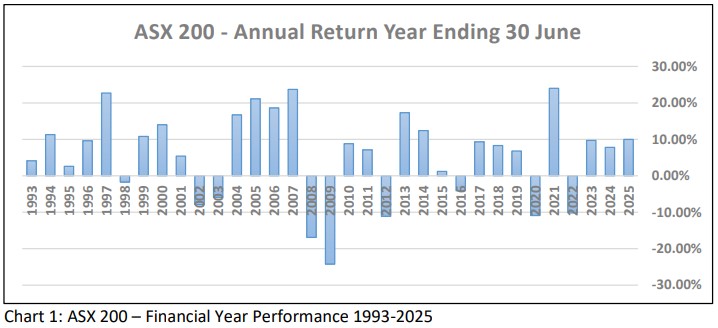

On a full-year basis, Australian investors generally enjoyed robust returns. The All Ordinaries and ASX 200 delivered gains of 9.5% and 10.0% respectively (before dividends), beating FY 2024’s 7.8% and aligning closely with FY 2023’s 9.7% return.

However, it is worth noting the concentration of companies on the Australian Stock Exchange. Our largest 10 companies presently comprise 42% of the market, with our big four banks and Macquarie making up a quarter of the index. Investment returns experienced by investors were influenced considerably depending on exposure to specific shares and particularly CBA.

Key Themes for FY 2026 and beyond

The new financial year is an opportune time to discuss what are likely to be key investment themes for FY 2026 and the years beyond.

1. Interest Rates

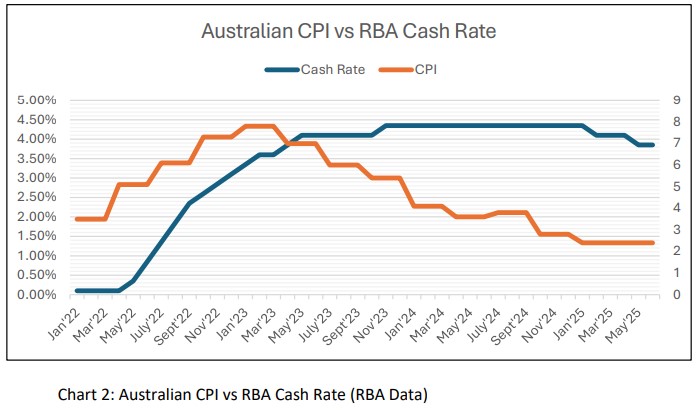

Interest rates remain a critical tool for central banks in managing inflation and economic growth. With inflation easing globally, rate cuts have followed in many developed economies:

- In the UK, official rates have fallen from 5.25% to 4.25% as CPI dropped from a 9.8% peak to 4.5%.

- In the US, rates have eased from 5.5% to 4.5%, with inflation down from 9.0% (June 2022) to 2.4%.

- In Australia, inflation has also declined from 7.8% (Dec 2022) to 2.4%, prompting a rate reduction from 4.35% to 3.85%.

Further cuts are widely expected. In Australia, at least one more 0.25% cut is anticipated before December, with the potential for several more by June 2026.

In the US, President Trump is applying pressure on Federal Reserve Chair Jerome Powell to reduce rates. Powell has resisted so far, citing risks of reigniting inflation via tariffs, but we expect a modest cut, likely 0.25%, in the coming months.

In the UK and EU, while inflation has receded, uncertainty lingers. Any further rate moves there may be slower and more cautious.

Lower rates tend to support share markets by encouraging investors to seek better returns from shares as opposed to the diminished returns achieved holding cash and fixed interest securities.

2. Economic Growth

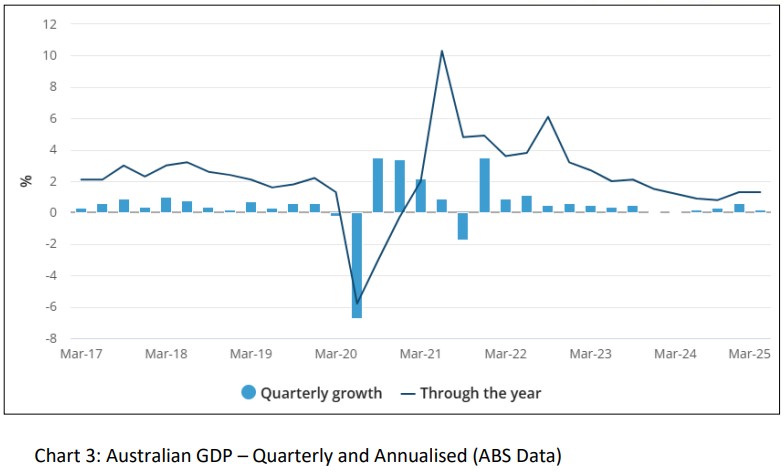

Australia’s economic growth remains subdued. GDP rose just 0.2% in the March 2025 quarter and only 1.3% over the past year. Expectations for FY 2025 sit at 1.4%–1.5%, with a modest lift to 1.9%–2.0% in FY 2026. Taking into account inflation, in real terms, Australia’s GDP has been declining.

This sluggish growth environment will likely constrain corporate profits—especially in sectors reliant on domestic economic strength, such as retail and discretionary spending.

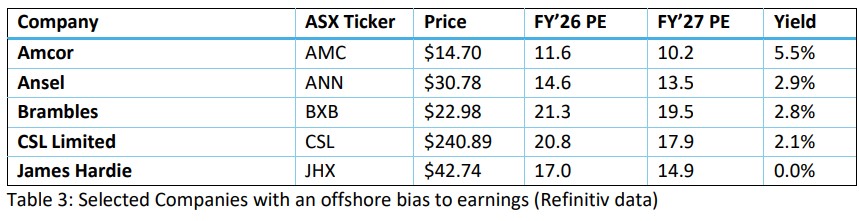

In contrast, we expect stronger performance from companies with significant offshore earnings, where growth rates are expected to be higher, Some examples of such companies with significant offshore earnings include:

3. Energy

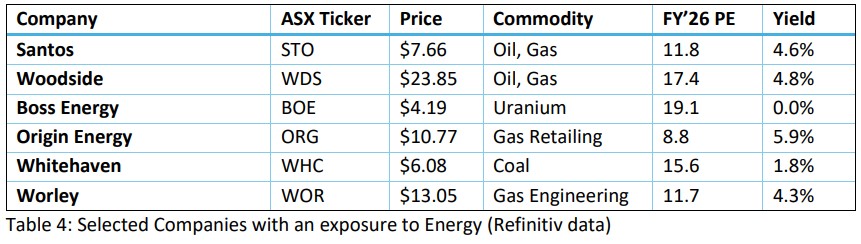

Recent months have seen a resurgence of investor interest in fossil fuels and uranium, as the limitations of the renewable transition become more widely acknowledged.

There’s growing recognition that a successful energy transition will still require baseload power from uranium, gas, and coal. This structural reality is likely to drive renewed investment focus on traditional energy producers throughout FY 2026.

Geopolitical tensions in the Middle East also pose risks to oil supply, creating further potential catalysts for price appreciation. Companies expected to benefit from these dynamics include:

AI continues to dominate headlines as businesses and policymakers grapple with its rapid evolution and societal implications. Its impact is already evident, tools like ChatGPT are transforming how we access information, automate workflows, and interact with technology.

While AI promises massive efficiency gains, the most significant consequence may be structural job displacement. Contrary to popular belief, AI is unlikely to be a net positive for employment in the short to medium term and certainly in the long term. Already, Amazon is nearing a point where robots outnumber human workers, graduate hiring in London has dropped sharply, and major tech firms like Meta and Microsoft are automating roles or downsizing.

The implications are profound. AI will reshape sectors such as banking, law, accounting, and advertising. In contrast, manual trades may see rising value due to their resistance to automation.

For investors, early AI adoption offers competitive advantage. While no single Australian company stands out as a pure-play AI leader, infrastructure providers like NextDC, Goodman Group (GMG) and Digico (DGT) are well positioned. The growing demand for data centres may see more REITs converting underutilised properties to support AI infrastructure needs.

5. Donald Trump

It’s unusual for a single individual to have such influence over global markets, but Donald Trump continues to be the exception.

As a disruptor by nature and a man in a hurry to reshape policy, his actions, particularly around trade, taxation, and regulation, can trigger sharp market reactions. The March tariff shock was a recent reminder of how quickly sentiment can shift.

That said, Trump’s goal of maintaining a strong US economy, especially to fund his “Big Beautiful Bill,” may limit the long-term impact of his more volatile moves.

From an investment perspective, FY 2026 may bring both market shocks and tactical buying opportunities. As such, maintaining a diversified portfolio with adequate liquidity (cash) will be important in navigating the year ahead.

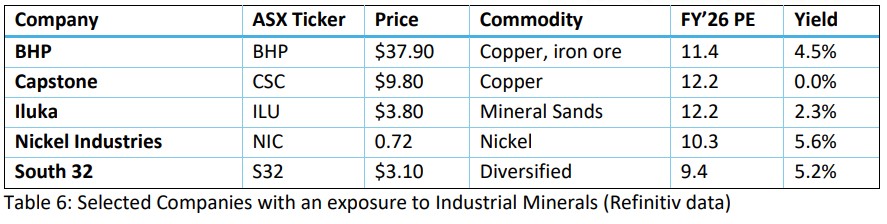

6. Commodities (Industrial Minerals)

Most industrial minerals—aside from copper—remain well below their 2022 highs. While those peaks were partly driven by COVID-related supply disruptions, a new round of supply-side challenges is now emerging.

- Nickel production in Australia has been heavily curtailed, with few new Western projects coming online. This is largely due to cost pressures from an influx of low-cost Indonesian supply.

- Aluminium faces a different issue: rising energy costs are discouraging new investment and accelerating the closure of older operations.

- Copper, while performing better in price terms, also faces future constraints. Low ore grades and tightening environmental regulations could limit supply beyond 2026.

These structural issues, combined with the prospect of stronger global demand, suggest conditions are ripe for a rally in resource stocks during FY 2026.

We see this as a compelling capital growth opportunity. Select companies well-positioned to benefit include:

Summary

These six themes are among the many factors likely to shape the Australian share market in FY 2026. As history shows, markets rarely follow a straight path—each year brings its own mix of challenges and opportunities.

From a top-down perspective, we remain constructive on the outlook. If the current momentum continues, FY 2026 could mark the fourth consecutive year of gains—something we haven’t seen since 2004–2007.

That said, we don’t expect growth to be uniform across all sectors. Australia faces headwinds, and these will weigh more heavily on some areas than others. We believe the resources sector is well placed to lead, supported by improving commodity prices and global demand.

Client Emails

In keeping with our earlier theme of technological disruption, we’ve encountered a technical issue affecting email delivery from some clients to Horizon staff.

Our IT team advises this is likely due to the absence of a Sender Policy Framework (SPF) record on the sender’s email domain. An SPF record verifies which servers are authorised to send on behalf of a domain—without it, messages may be incorrectly flagged as spam.

If you’ve emailed Horizon and haven’t received a reply within two business days, please phone your adviser or contact the office directly so we can follow up promptly.

Tiana Moralee

We’re pleased to welcome Tiana Moralee to the Horizon team. Based in our Perth office, Tiana joins us as our Onboarding and Client Services Officer while completing a Bachelor of Commerce (majoring in Financial Planning) at Curtin University.

We hope you find these monthly reports valuable and informative. If you have any feedback on the content or format, please don’t hesitate to share it with your adviser, we always welcome your input.