PLEASE BE ADVISED THE HORIZON OFFICE WILL BE CLOSED OVER THE CHRISTMAS NEW YEAR PERIOD FROM MONDAY 22nd DECEMBER AND WILL OPEN AGAIN MONDAY 5th JANUARY 2026.

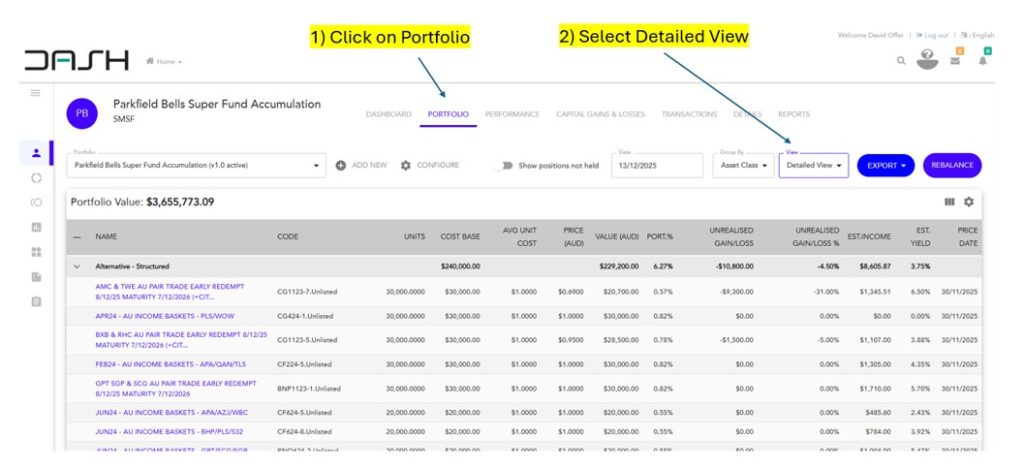

After a bumpy start to the new reporting platform offered by DASH, which has come about due to DASH acquiring our back office ‘Integrated Portfolio Solutions (IPS)’ in the prior year, DASH is now finally starting to make some inroads towards providing a satisfactory reporting platform.

This has started by providing a new layout that more clearly details an investment portfolio and includes showing investments by asset class, the respective gain or loss on an investment held and estimated income to be received.

To access this portfolio layout, once you have logged onto the DASH portal via the Horizon website, please follow the two steps below.

DASH are aware and accept that their reporting platform is deficient and addressing this will be a priority in the new year. As previously discussed, in an ideal world, the transition from the prior Praemium reporting platform would have been delayed until a more suitable reporting layout was ready to be rolled out. However, the Praemium exit date was a hard date (31 July 2025), and hence the existing layout has had to suffice. Now that the migration of data to the DASH platform has concluded and the provision of 2024-25 taxation reports almost completed, in the new year, DASH will focus on enhancing the user experience – both from a client and advisor perspective.

We thank you for your continued patience. While it has been a frustrating transition, DASH is working hard and both back-office operations, and the quality of reporting, should normalise in the new year.

Moving to the state of the Australian share market, while 2025 was a year of considerable volatility, the final result appears to be one of relatively normalised share market returns.

At the time of writing, the All-Ordinaries index, from starting at 8,420 points, is up 563 points for the year, a return of 6.7%. At the low point of the Trump tariff sell-off in April, the market was down 12.8% and from the April low of 7,340 points, has recovered an impressive 22.3% for the year to date. ‘Buying the dip’ has once again proven to have paid off.

Our share-market is dominated by financials, of which the Big Four Banks comprising Commonwealth Bank (CBA), National Australia Bank (NAB), Westpac (WBC) and ANZ Group (ANZ) make up 25% to 28% of the value of the Australian share market and materials (resource shares), of which the iron ore majors BHP Group (BHP), RIO Tinto (RIO) and Fortescue (FMG), make up a further 15% – 18%. Accordingly, just 7 companies across two sectors, make up 40% to 45% of the value of our market. Consequently, how these two sectors perform, sets the tone for the market overall.

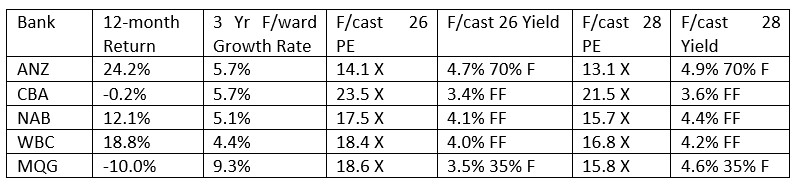

With respect to the Big Four bank shares, annual return over the year to date is summarised below:

While the Commonwealth Bank share price has dominated news headlines, thanks to hitting a jaw dropping price of $192.00 in June, its subsequent pull back to $155.96 has resulted in a flat return for the year. The two bank shares we have favoured, ANZ and WBC, have performed the best, rising 24% and 19% respectively over thAe calendar year.

In the year ahead, we hold minimal optimism for positive returns being generated from holding any of the Big Four bank shares. In the 28 years I have been an Investment Advisor, I have never seen bank shares trade anywhere close to their current earnings multiples. To contrast, in a bear market, it is not uncommon to see bank shares trade on PE multiples of less than 10 times and dividend yields of more than 6%.

While analysts now project modest earnings per share growth for the Big Four bank shares going forward (summarised above in the 3-year forward growth rate), potentially this could be due to analysts simply trying to justify present sky-high valuations. Analysts are notorious for overstating future earnings per share growth and, in this regard, we express some cynicism. Even if forecast growth rates did eventuate, current valuations still appear excessive.

One reason for the current high valuations could be index buying by US fund managers as they seek to hold non-US currency investments so that they can profit should the US dollar subsequently be sold down. It is no secret that the Trump Administration would like to see the US dollar devalued to make US businesses and their exports more competitive. If so, it is unlikely that any such buying will be sustainable and could easily reverse should the US dollar depreciate such that funds are ultimately repatriated back to the US.

Consequently, for existing long-term investors, we are continuing to trim our bank positions to ensure we are significantly under-weight in the Big Four. For both existing and new investors, our only banking preference is Macquarie Group.

The Macquarie Group share price has had a tough 12 months and is off 10% for the year. However, as a business, it has proven to be able to grow its profits steadily over the long term. Given it is presently trading in line with the Big Four, but with superior future growth expected, we consider it the most likely major bank to generate positive returns. Importantly, Macquarie is considerably more diverse than the Big Four, which overwhelmingly compete on price sensitive residential mortgages and are prone to interest margin compression as they compete for market share.

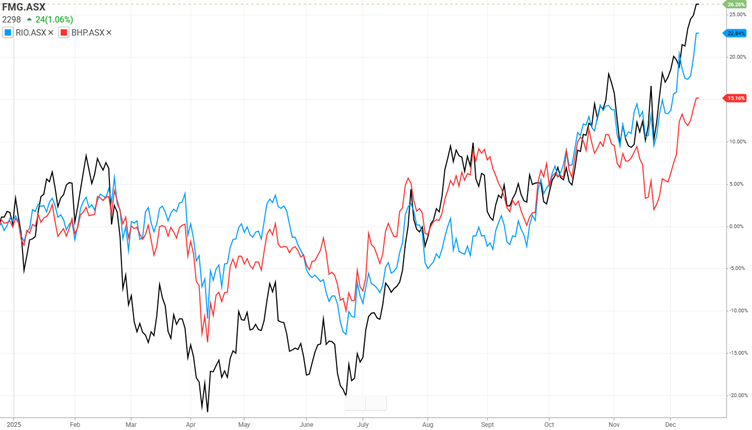

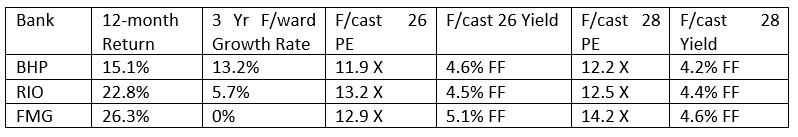

Looking at our three major resource shares, BHP, RIO and FMG, their performance for the year is summarised below.

This strong performance has originated from in part, FMG partially recovering from a previously significant fall in share price, as the Company reduced its focus on loss making green hydrogen and other renewable energy projects. All three companies are predominantly iron ore focused and have benefited from iron ore finishing the year at a 12-month high of $US 107 a tonne. It is not uncommon for iron ore to tick up in price into December as Chinese steel mills rebuild inventories prior to winter production curbs. Both BHP and RIO also benefited from their copper exposure, with the copper price appreciating approximately 30% over calendar 2025. RIO additionally benefited thanks to its newly acquired lithium exposure.

Of the three resource majors, our preference is BHP, but to ideally acquire on share price weakness – preferably closer to $40. This could easily occur should BHP again approach Anglo as a takeover target or on a subsequent dip in commodity prices. We are inclined to sell RIO on the back of a now stretched valuation as companies exposed to lithium seem to have rebounded excessively on a relatively small uptick in the lithium price. We consider FMG a hold, but overall prefer BHP given it is the lowest cost iron ore producer and has a more diversified commodity base to provide insulation against a fall in any one commodity, such as the iron ore price.

There is a lot of interest in the resource sector at the current time thanks to the stunning rally in gold shares and other specific commodity stocks, such as those exposed to lithium. While such rallies spark interest, there is little to gain in investing in shares once they have gone up. The trick is for investors to find exposure to unloved commodities yet to run, to ultimately sell once they come into favour.

In looking for value, one interesting long-term valuation measure within commodity markets is the gold-to-oil ratio, which reflects how many barrels of oil can be purchased with one ounce of gold. Historically, this ratio has tended to oscillate within a broad but stable range. Today, with the current ratio of 69 – 74 barrels of oil per ounce of gold, this sits well above long-term averages of 10 – 20 barrels of oil per ounce of gold, indicating that the oil price is extremely low relative to the gold price. In past cycles, such valuation extremes have typically resolved through higher oil prices rather than a lower gold price.

More importantly, this valuation signal is emerging against a backdrop of structural supply constraints. Global investment in oil has been insufficient for more than a decade. As a result, new project approvals have lagged established oil field declines, reducing future supply capacity, even under conservative demand assumptions.

At the same time, global oil demand continues to rise, particularly as India transforms into a modern economy. ‘Peak oil’ which reflects when global oil consumption is expected to hit its maximum level, is continually pushed back in time, and is now not expected until the early 2030s. Even then, the oil price can still rise should supply fall faster than demand.

Holdings in Woodside Energy and Santos provide leverage to any future re-rating in the oil price. While both companies are predominantly LNG-focused, they also produce meaningful quantities of oil, offering direct sensitivity to higher oil prices alongside more stable LNG cashflows.

On the topic of LNG, the expansion of renewable energy globally has increased the need for reliable, dispatchable power sources to stabilise electricity grids. LNG is set to play an increasingly critical ongoing role in this transition, providing baseload and peaking capacity where renewables are intermittent. LNG demand growth across Asia is being underpinned by long-dated contracts, population growth, and industrial expansion. While new LNG supply will be boosted by new projects in the US and Qatar, the widespread availability of LNG should further assist in LNG demand through permanently substituting coal in the global energy mix.

Worley, an engineering and project services Company leveraged to sustained investment in energy infrastructure, is an alternative way we are also gaining exposure. Worley will benefit from increased capital expenditure across oil, gas, LNG as well as renewable energy projects.

As the year draws to a close, thank you for your ongoing support. No doubt calendar 2026 will bring its own unique challenges and unexpected investment ‘curve balls’. However, we are confident that portfolios are structured to weather a wide range of potential investment scenarios.

We wish you all the best for the festive season and look forward to continuing to be of assistance in the new year.